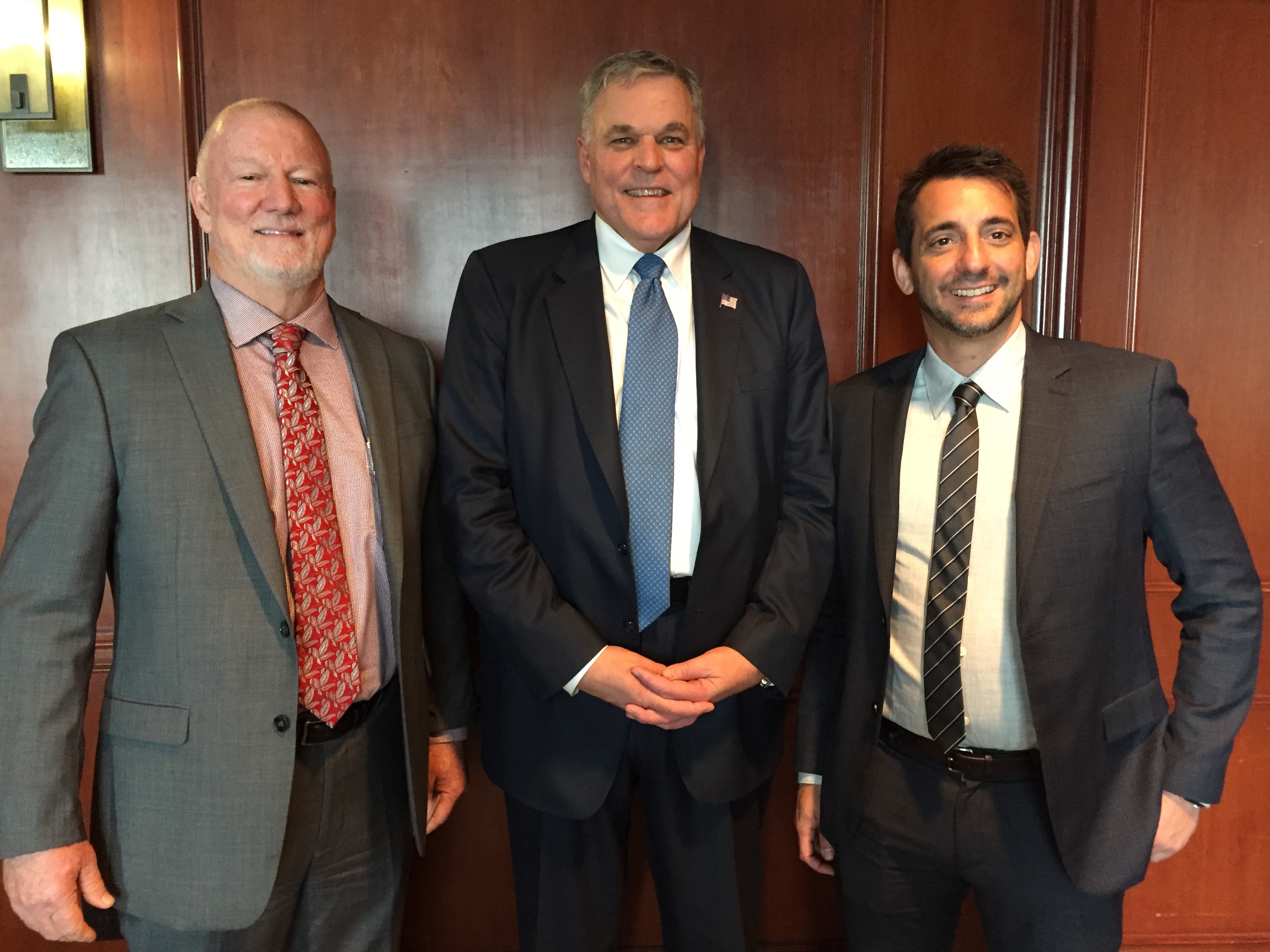

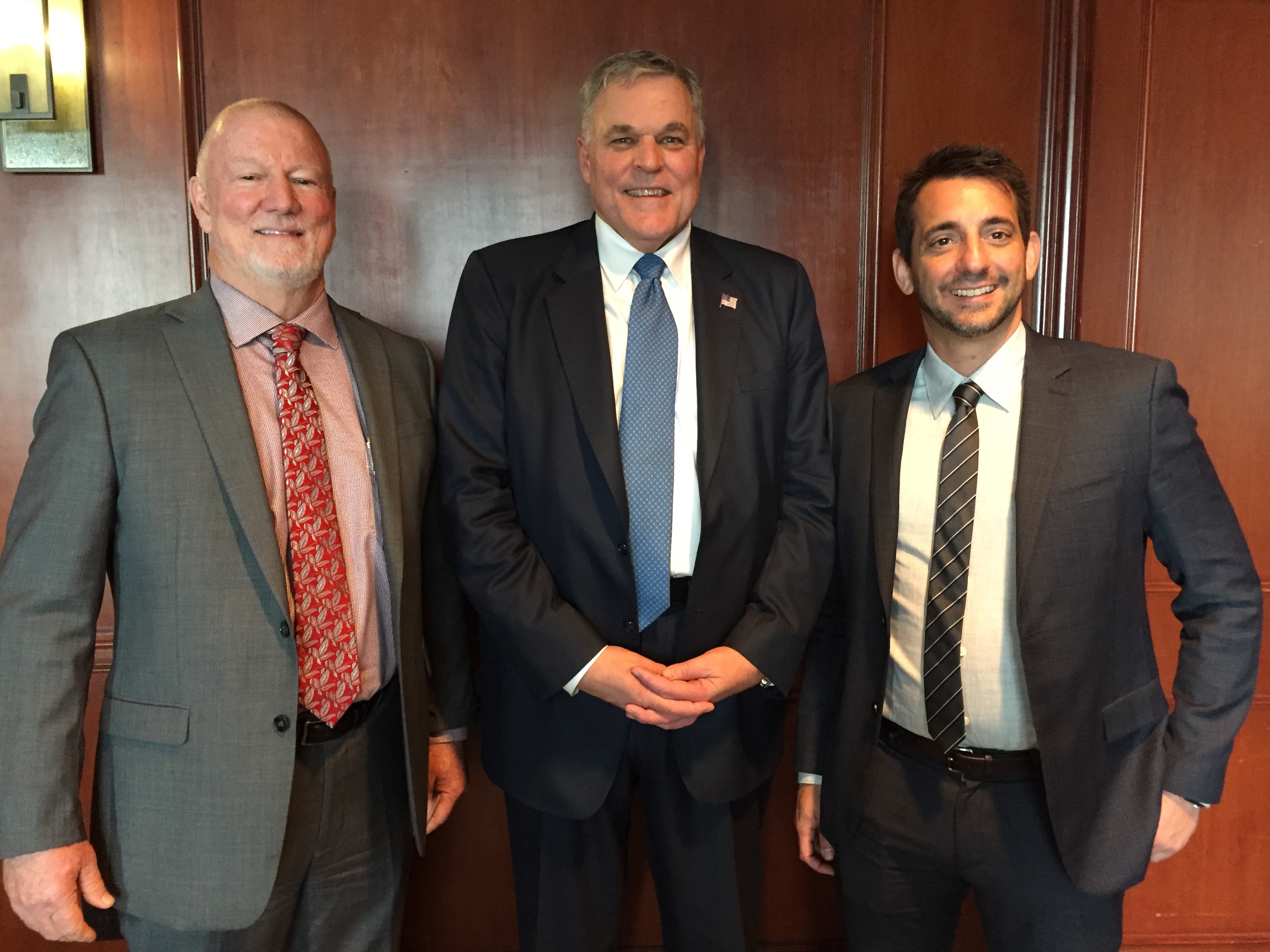

During this month’s FICPA and Florida Bar International Tax Conference in Miami, IRS Commissioner Chuck Rettig addressed 500 CPAs and attorneys and discussed how the passion among his collective “we” at the IRS can make a difference, and that he is a huge advocate for taxpayer service. Rettig shared with the audience that before becoming Commissioner, he practiced as a tax litigation lawyer for 36 years, so he understands what it is like to be on the practicing side of the profession. Rettig said he is honored to be at the IRS to serve our country, and it was clear from his passion that he is leading his dream life at the IRS.

The Commissioner also talked policy, sharing that in 2018, 83.6% of taxpayers were in compliance. He is a supporter of VITA and tax counseling for the elderly and military. He asked that CPAs consider volunteering with VITA or other volunteer programs, as these organizations make a meaningful difference by helping taxpayers remain in compliance. The tax form Schedule 1 now has a new checkbox question: “At any time did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” This is important for practitioners to ask their clients as all transactions must be reported.

Looking forward, Rettig envisions a more automated future at the IRS, including the use of “chat bots” coming soon to those that have internet access and want to ask questions. The IRS currently accommodates 6 languages, but Retting’s plan is to add services in additional foreign languages so that the IRS is more accessible and compliance rates increase.